Corporate Tax Table 2024

Corporate Tax Table 2024. Remember, domestic and resident foreign corporations face a minimum corporate income tax (mcit) of 2% of gross income, temporarily reduced to 1% until. 151 rows switzerland (last reviewed 16 january 2024) federal cit:

For tax years beginning after 2022, the inflation reduction act of 2022 amended section 55 of the internal revenue code to impose a new corporate alternative minimum tax. The following corporate and withholding tax rate changes apply as from 1 january 2024 (unless otherwise noted).

New Swiss Company Tax Rate Set For 2024.

A c corp uses form 1120 to report its earnings and claim its tax credits and deductions.

The Swiss Government Decided On Friday To Introduce Part Of The Oecd/G20 Tax Reform As Planned On January 1, 2024.

The income of a corporation is qualified as business income that is subject to corporate tax and municipal trade tax at an approximate total rate of 30%.

Kpmg’s Corporate Tax Table Provides A View Of Corporate Tax Rates Around The World.

Images References :

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Hungary (9 percent), ireland (12.5 percent), and lithuania (15 percent) have the lowest corporate income tax rates. Us tax reform legislation enacted on 22 december 2017 (p.l.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Corporate tax definition and meaning Market Business News, Its income is typically taxed at the corporate level based on the following. Federal and provincial/territorial tax rates for income earned by a general corporation—2024 and 2025.

Source: ondemandint.com

Source: ondemandint.com

Singapore Corporate Tax Rate Singapore Taxation Guide 2021, On average, the european countries analyzed. As of 2023, corporate tax rates in switzerland have seen minimal reductions, with the average ordinary corporate tax rate slightly decreasing from 14.68% to 14.6%.

Source: 2023vjk.blogspot.com

Source: 2023vjk.blogspot.com

10+ Calculate Tax Return 2023 For You 2023 VJK, Stay informed about tax regulations and calculations in switzerland in 2024. Kpmg’s corporate tax table provides a view of corporate tax rates around the world.

Source: www.chegg.com

Source: www.chegg.com

Solved 1. Using the corporate tax table above, what is the, The corporate tax 2024 guide provides the latest legal information on types of business entities, special incentives, consolidated tax grouping, individual and corporate tax rates,. Its income is typically taxed at the corporate level based on the following.

![[Ask the Tax Whiz] How to compute tax under the new tax](https://www.rappler.com/tachyon/2023/01/8.jpg) Source: www.rappler.com

Source: www.rappler.com

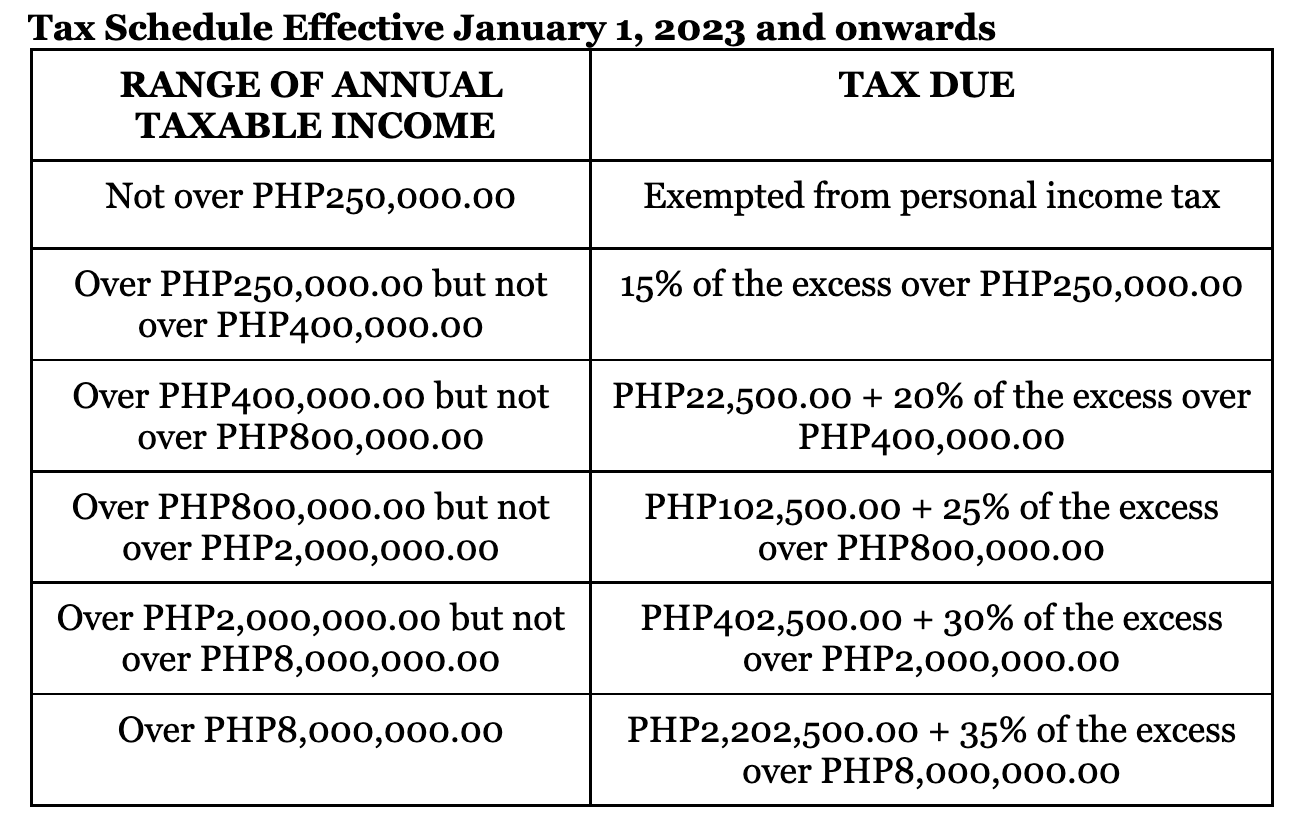

[Ask the Tax Whiz] How to compute tax under the new tax, Discover the switzerland tax tables for 2024, including tax rates and income thresholds. The following corporate and withholding tax rate changes apply as from 1 january 2024 (unless otherwise noted).

Source: e.zone

Source: e.zone

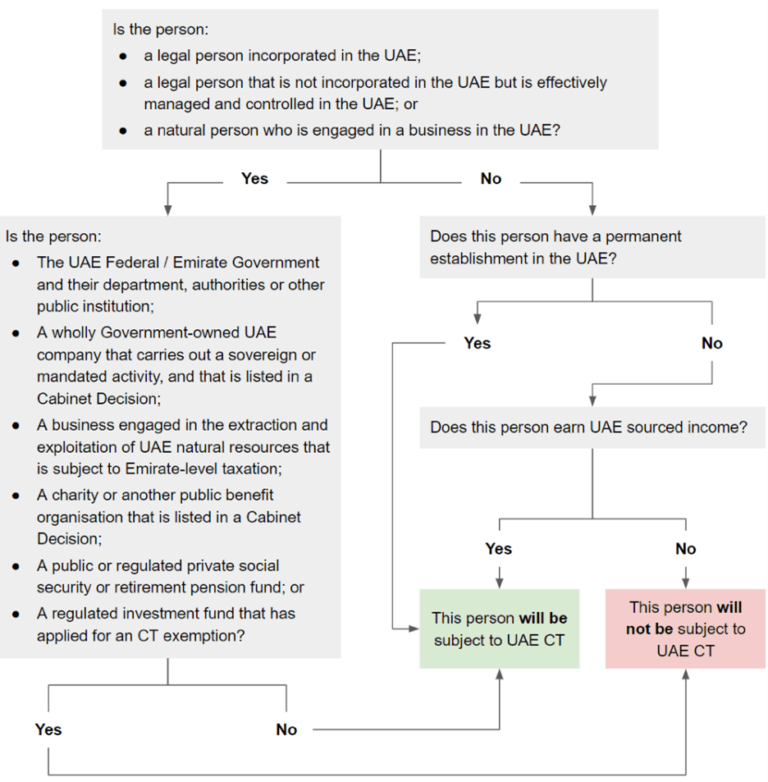

What you need to know about the New Corporate Tax Law in the UAE EZONE, Hungary (9 percent), ireland (12.5 percent), and lithuania (15 percent) have the lowest corporate income tax rates. The level of urgency for legislative efforts will ultimately come down to how potential double taxation affects us companies, and what impact compliance with the international.

Source: www.spot.ph

Source: www.spot.ph

BIR Tax Schedule Effective January 1 2023, Corporate tax rates by state 2024. For information on the implementation of the.

Source: www.hamptons.ae

Source: www.hamptons.ae

UAE Corporate Tax 2023 and Property Investments, The swiss government decided on friday to introduce part of the oecd/g20 tax reform as planned on january 1, 2024. In 2024, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Source: seekingalpha.com

Source: seekingalpha.com

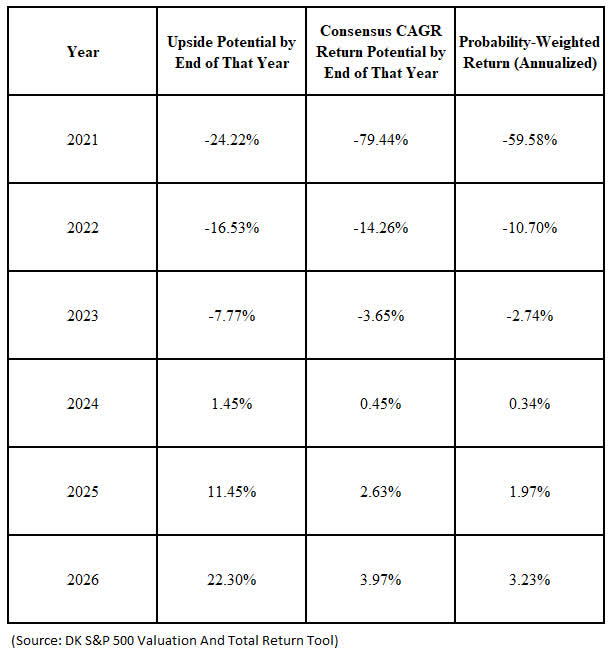

What Investors Need To Know About Corporate Taxes In 2022 Seeking Alpha, New swiss company tax rate set for 2024. Corporate tax rates by state 2024.

On 12 January 2022, The Federal Council Decided To Implement The Minimum Tax Rate For Companies That Was Agreed By.

On average, the european countries analyzed.

Explore The Latest Corporate Income Tax Rates By State With Our 2024 Corporate Tax Rates Map.

151 rows switzerland (last reviewed 16 january 2024) federal cit: