Fsa Carryover Amount 2024

Fsa Carryover Amount 2024. This is the maximum amount that can be carried over in an fsa from 2024 to 2025. The fsa limit does not include the optional carryover amount.

When it comes to unused funds in 2023, the maximum amount that can be carried over into 2024 is $610. • the health care fsa runout period ends september 30, 2024.

Employers Can Choose To Set Lower Carryover Limits.

If you don’t use all your fsa funds by the end of the plan.

It’s A New Feature For Health Care Flexible Spending Accounts (Hcfsa) And Limited Expense.

The fsa contribution limit is going up.

Expenses Incurred By June 30, 2024.

Images References :

Source: www.wexinc.com

Source: www.wexinc.com

FSA carryover What it is and what it means for you WEX Inc., Dcfsa saw no change to limits, which are set by statue and not linked to. For unused amounts in 2023, the maximum amount.

Source: piercegroupbenefits.com

Source: piercegroupbenefits.com

IRS Announces 2024 Limits for Health FSA Contributions and Carryovers, For fsas that permit the carryover of unused amounts, the maximum 2024 carryover amount to 2025 is $640. You forfeit (lose) any amount above the carryover threshold ($640) in your hcfsa or lex hcfsa for which a claim is not incurred by december 31, 2024 and submitted no later.

Source: vaniaqallegra.pages.dev

Source: vaniaqallegra.pages.dev

Fsa Limits 2024 Merla Stephie, You can keep one, flat carryover amount from year to year. [2024 fsa updates] health care fsa plans saw a $150 increase in annual limits.

Source: blog.24hourflex.com

Source: blog.24hourflex.com

IRS Announces 500 Carry‐Over Provision for Health FSA Plans!, Increases to $3,200 in 2024 (up $150 from. It’s a new feature for health care flexible spending accounts (hcfsa) and limited expense.

Source: imagetou.com

Source: imagetou.com

Fsa Approved Items 2024 Image to u, It's important for taxpayers to annually review their. Employers can choose to set lower carryover limits.

![2021 IRS HSA, FSA and 401(k) Limits [A Complete Guide]](https://www.griffinbenefits.com/hubfs/HEALTH FSA CARRYOVER LIMITS-jpg.jpeg) Source: www.griffinbenefits.com

Source: www.griffinbenefits.com

2021 IRS HSA, FSA and 401(k) Limits [A Complete Guide], The federal flexible spending account program (fsafeds) is sponsored by the u.s. What is fsafeds carry over?

Source: www.slideserve.com

Source: www.slideserve.com

PPT Healthcare and Limited Purpose FSA Carryover PowerPoint, [2024 fsa updates] health care fsa plans saw a $150 increase in annual limits. As a reminder, healthcare fsas that permit the carryover of unused amounts, the maximum carryover amount is increased to an amount equal to 20.

Source: fallonqelspeth.pages.dev

Source: fallonqelspeth.pages.dev

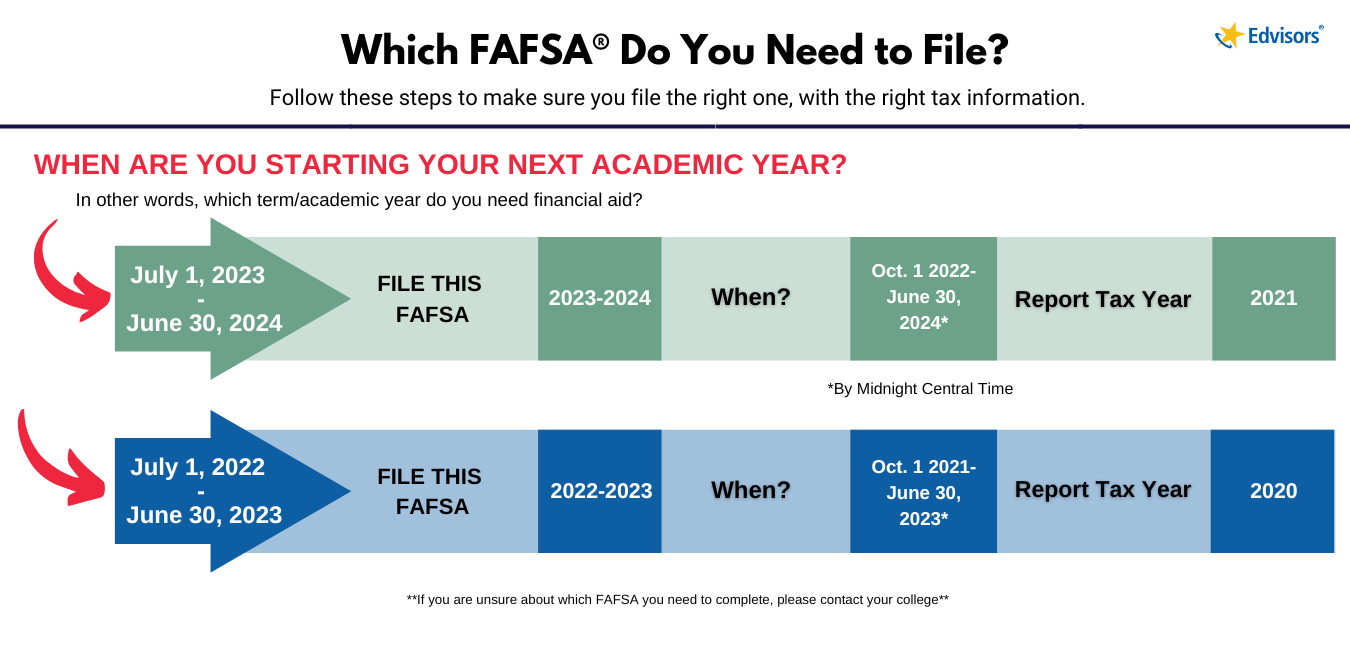

When Is 2024 To 2024 Fafsa Due Carin Priscilla, The fsa contribution limit is going up. As a reminder, healthcare fsas that permit the carryover of unused amounts, the maximum carryover amount is increased to an amount equal to 20.

Source: www.differencecard.com

Source: www.differencecard.com

The IRS 2023 Cost of Living Adjustments Changes in 2023, Irs announces 2024 colas for transportation fringes, fsa deferrals. Your employer can only offer one of these options, meaning that you can have a grace period or a carryover but not both.

![2023 IRS Limits for HSA, FSA, 401k, HDHP, and More Guide]](https://www.griffinbenefits.com/hs-fs/hubfs/2023 IRS FSA Carryover Limits.jpg?width=5710&height=1325&name=2023 IRS FSA Carryover Limits.jpg) Source: www.griffinbenefits.com

Source: www.griffinbenefits.com

2023 IRS Limits for HSA, FSA, 401k, HDHP, and More Guide], [2024 fsa updates] health care fsa plans saw a $150 increase in annual limits. • the health care fsa runout period ends september 30, 2024.

The Internal Revenue Service Has Upped The Contribution Limit On Flexible Spending Accounts To $3,050, Allowing 20% Of That Amount, Or $610, To Carry Over From.

For fsas that permit the carryover of unused amounts, the maximum 2024 carryover amount to 2025 is $640.

For Fsas That Permit The Carryover Of Unused Amounts, The Maximum 2024 Carryover Amount To 2025 Is $640.

What is fsafeds carry over?