Georgia State Income Tax Refund 2024

Georgia State Income Tax Refund 2024. For 2023 (tax returns filed in 2024), georgia has six state income tax rates: 1%, 2%, 3%, 4%, 5% and 5.75%.

These rate reductions can be delayed by one year for each year that certain budget requirements are not met. The georgia department of revenue (dor) will begin processing 2023 individual income tax returns on friday, february 2, 2024.

A Person Making $45,000 A Year Will Save About $45 On Their 2024 Income Tax.

Use the following resources to find where your georgia state tax refund using.

Where’s My Georgia State Tax Refund?

If the proposal is approved, the tax rate for 2024.

Georgia’s Income Tax Landscape Has Already Undergone Recent Changes.

Images References :

Source: printableformsfree.com

Source: printableformsfree.com

Ga State Refund Cycle Chart 2023 Printable Forms Free Online, Those with an income of $75,000 a year will see an estimated $75 decrease. Georgia individual income tax returns must be received or postmarked by the april 15, 2024 due date.

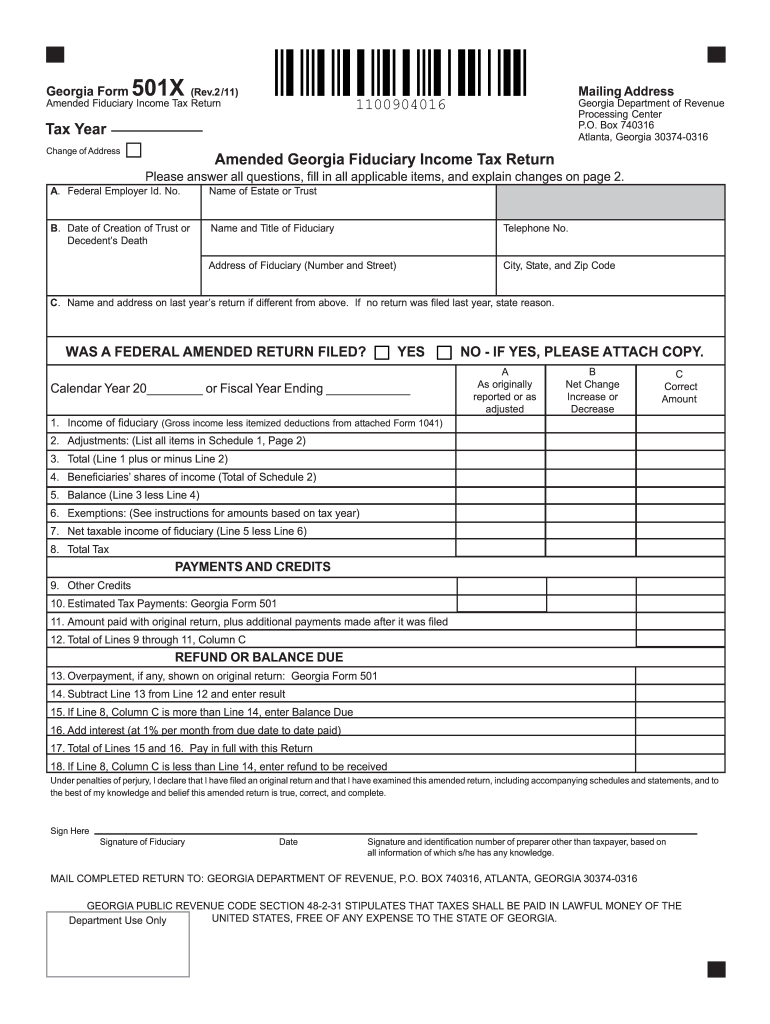

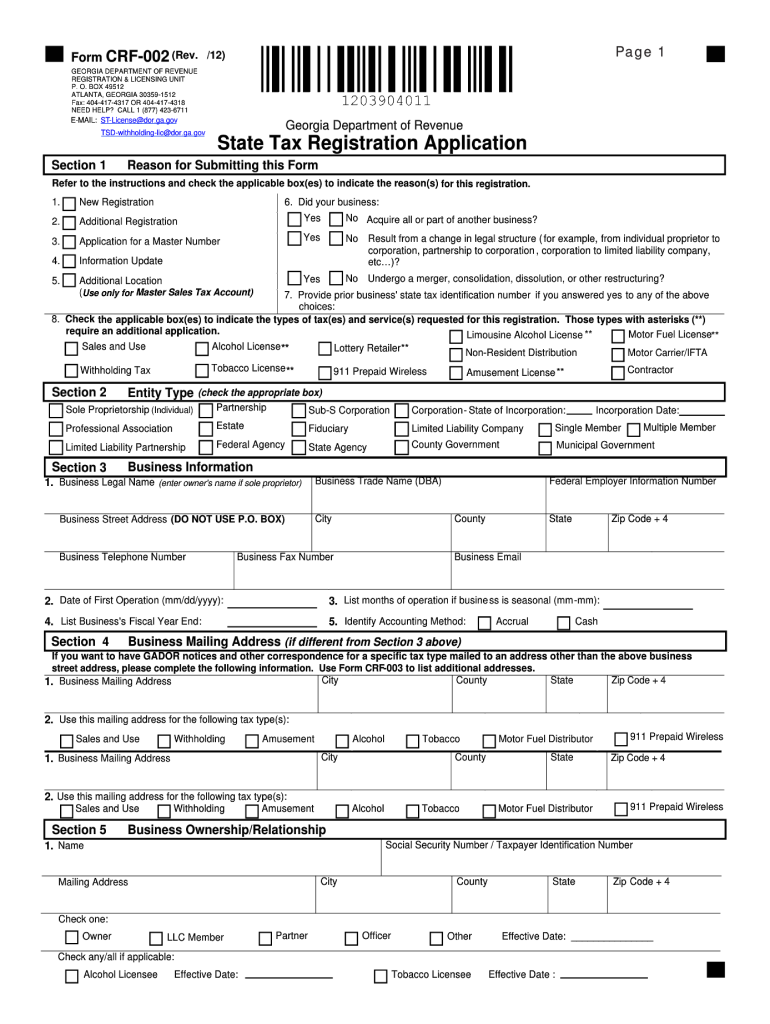

Source: www.dochub.com

Source: www.dochub.com

tax return Fill out & sign online DocHub, Kemp signed hb 162 into law yesterday, providing for a special. As of monday, the new year brought in a new tax rate, lowered from an income tax of 5.75% to 5.49%.

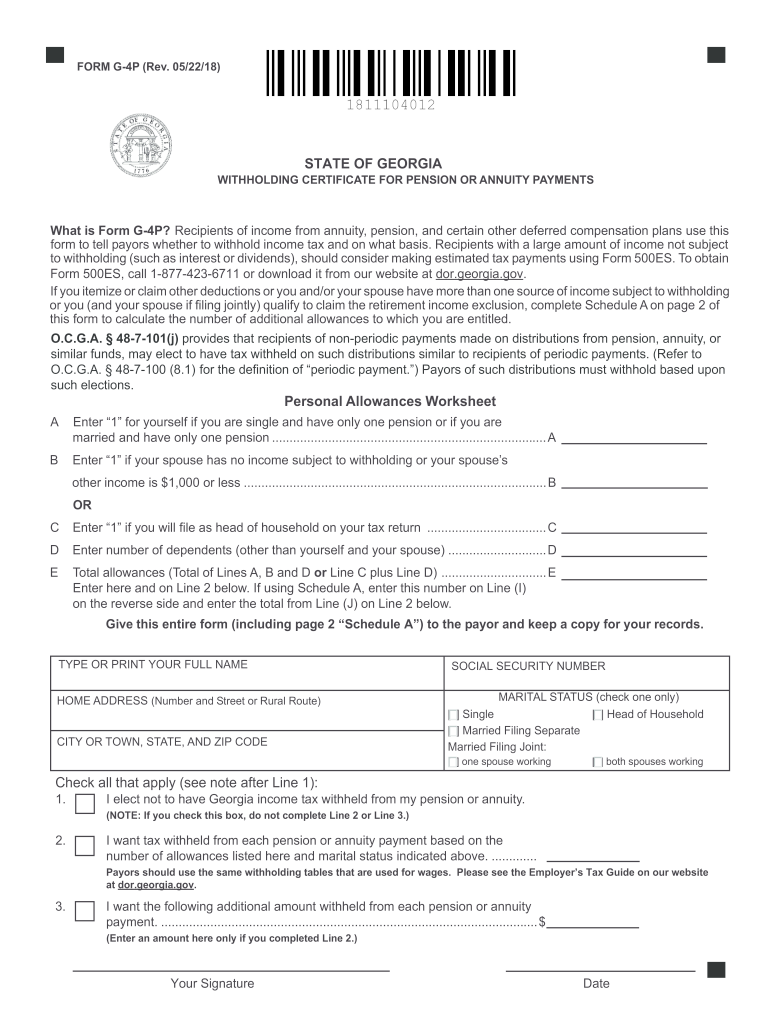

Source: www.dochub.com

Source: www.dochub.com

w4p form Fill out & sign online DocHub, As of monday, the new year brought in a new tax rate, lowered from an income tax of 5.75% to 5.49%. Brian kemp says special state income tax refunds will begin this week, although it could be early august before everyone who filed a return before the april.

Source: neswblogs.com

Source: neswblogs.com

2022 State Tax Brackets Latest News Update, House bill 1302 will give a $250 refund to single filers, $375 to single adults who head a household with dependents and $500 to married couples filing jointly. Those with an income of $75,000 a year will see an estimated $75 decrease.

500 Ga Tax Refund 2024 Mufi Tabina, Kemp signed hb 162 into law yesterday, providing for a special. Georgia individual income tax returns must be received or postmarked by the april 15, 2024 due date.

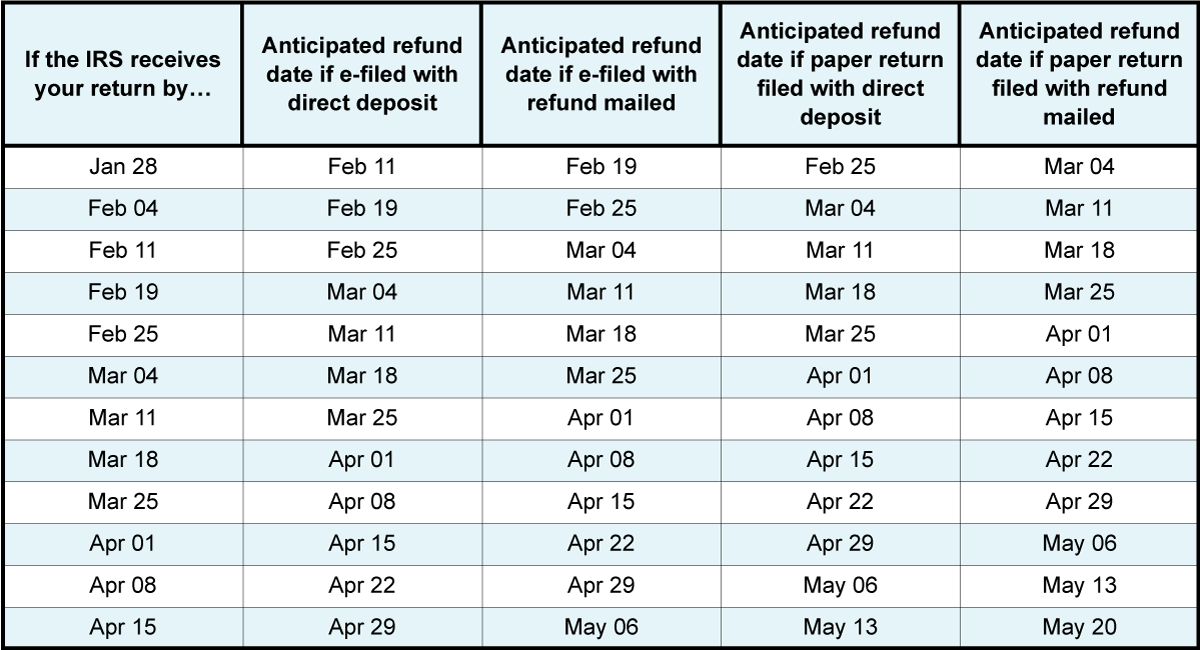

Source: indiraqzorine.pages.dev

Source: indiraqzorine.pages.dev

Irs Tax Refund Dates 2024 Jaime Blondelle, House bill 1302 will give a $250 refund to single filers, $375 to single adults who head a household with dependents and $500 to married couples filing jointly. Georgia individual income tax returns must be received or postmarked by the april 15, 2024 due date.

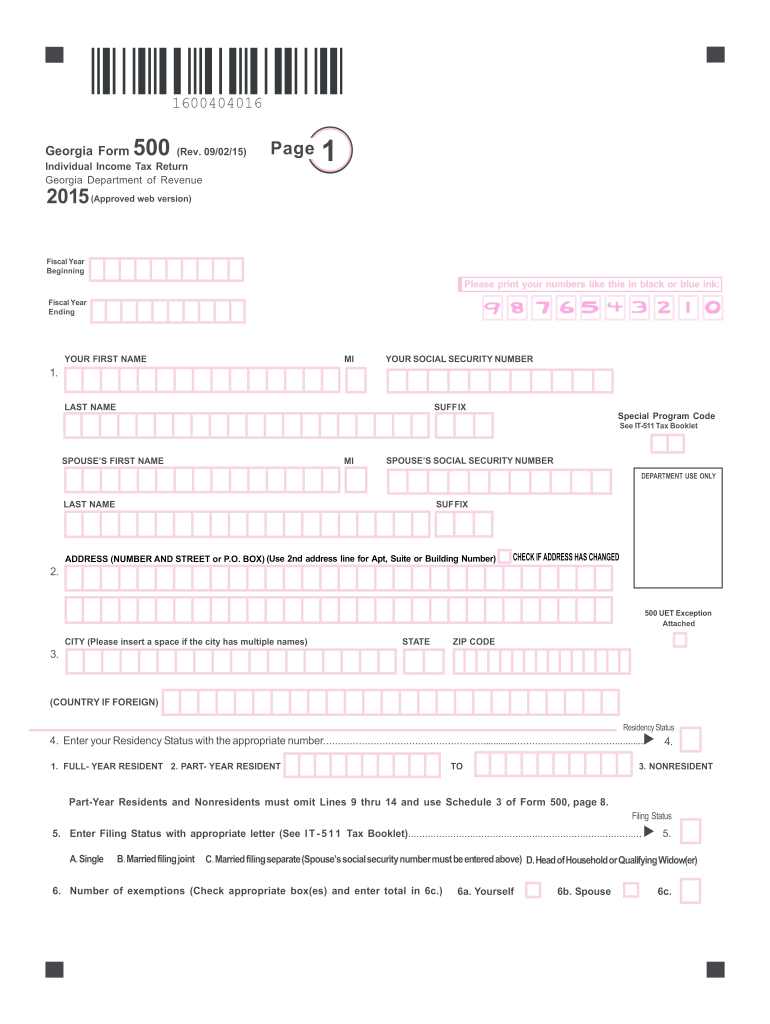

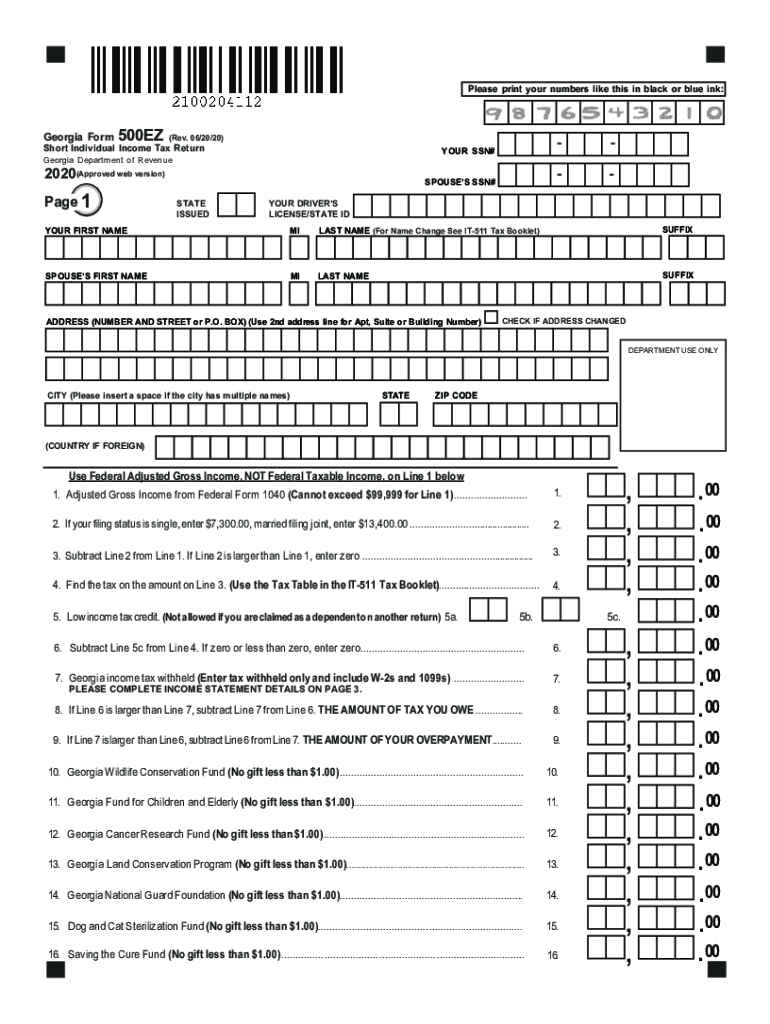

Source: www.dochub.com

Source: www.dochub.com

state tax form Fill out & sign online DocHub, The georgia state department of revenue is where you can find your ga state tax refund status. The georgia department of revenue (dor) will begin processing 2023 individual income tax returns on friday, february 2, 2024.

Source: www.dochub.com

Source: www.dochub.com

state tax form Fill out & sign online DocHub, The georgia department of revenue (dor) will begin processing 2023 individual income tax returns on friday, february 2, 2024. Kemp signs state income tax refund bill.

Source: serious-mumma.blogspot.com

Source: serious-mumma.blogspot.com

Ga State Tax Refund Serious Mumma, The latest state tax rates for 2024/25 tax year and will be update to the 2025/2026 state tax tables once fully published as published by the various states. A person making $45,000 a year will save about $45 on their 2024 income tax.

Source: www.signnow.com

Source: www.signnow.com

Tax Complete with ease airSlate SignNow, Where’s my georgia state tax refund? On this page find information on what is required to file your.

For 2023 (Tax Returns Filed In 2024), Georgia Has Six State Income Tax Rates:

Kemp, accompanied by first lady marty kemp, members of the.

Where’s My Georgia State Tax Refund?

The georgia state department of revenue is where you can find your ga state tax refund status.